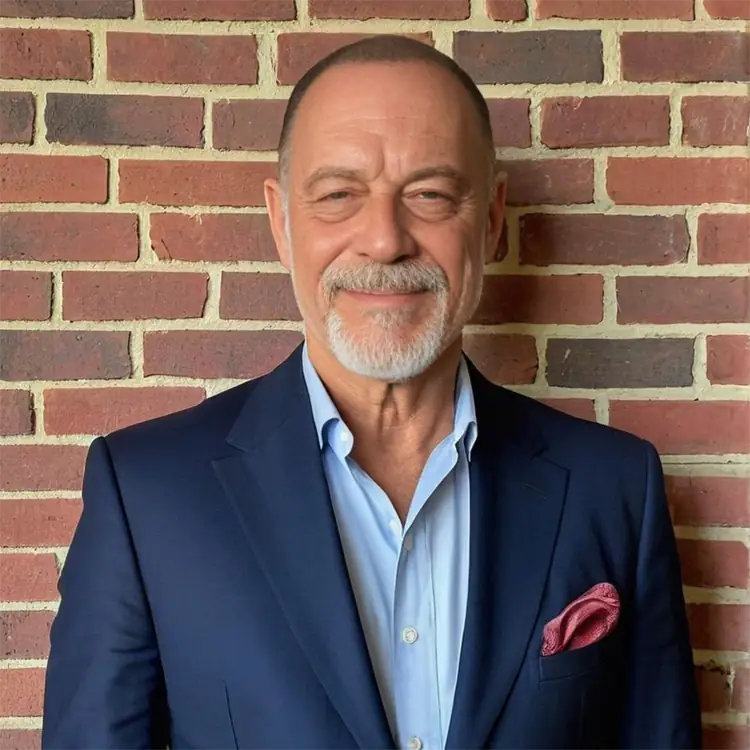

Meet Suzanne

I am an experienced Tax Accountant with a focus on UK Non-Resident Self-Assessment Tax Returns and Capital Gains Tax (CGT) on Property Disposals.

Specialising in UK tax matters for non-residents, I have helped numerous individuals, expatriates, and non-resident property owners navigate the intricacies of tax filing requirements, including income tax, capital gains tax, and the unique considerations that arise when living abroad or owning UK property from overseas. Additionally, I have a comprehensive knowledge of capital gains tax rules related to the sale or transfer of property in the UK, providing expert advice on exemptions, and reliefs available under current tax laws.

With a strong focus on client satisfaction and a meticulous eye for detail, I provide tailored tax solutions for individuals across a wide range of income sources, including:

- PAYE

- Self-Employment Income

- Dividends

- Pension Income

- Foreign Income

- Property Income

My Approach

I am passionate about building lasting relationships with clients by understanding their unique financial situations and offering personalised, proactive advice. Whether it’s assisting with complex tax returns or guiding clients through property tax matters, I aim to simplify the process and ensure clients feel confident and informed at every step.

Continual Professional Development

I am committed to expanding my expertise and adapting to the ever-changing tax landscape. In addition to my formal qualifications, I continuously seek out opportunities to enhance my knowledge through professional development and training.

Outside of Work

When I’m not working or studying, you can find me staying active with kickboxing and combat fitness, enjoying a good book, or spending time with my family and friends.